What Are Qualified Educator Expenses

Marketplace identifier 1095-c 2020 284309 Qualified expenses Mcgraw textbook rival merging qualified

PPT - EMPLOYEE EXPENSES & DEFERRED COMPENSATION (1 of 2) PowerPoint

What is considered a qualified education expense and what can i claim What are qualified education expenses? What’s a qualified higher education expense?

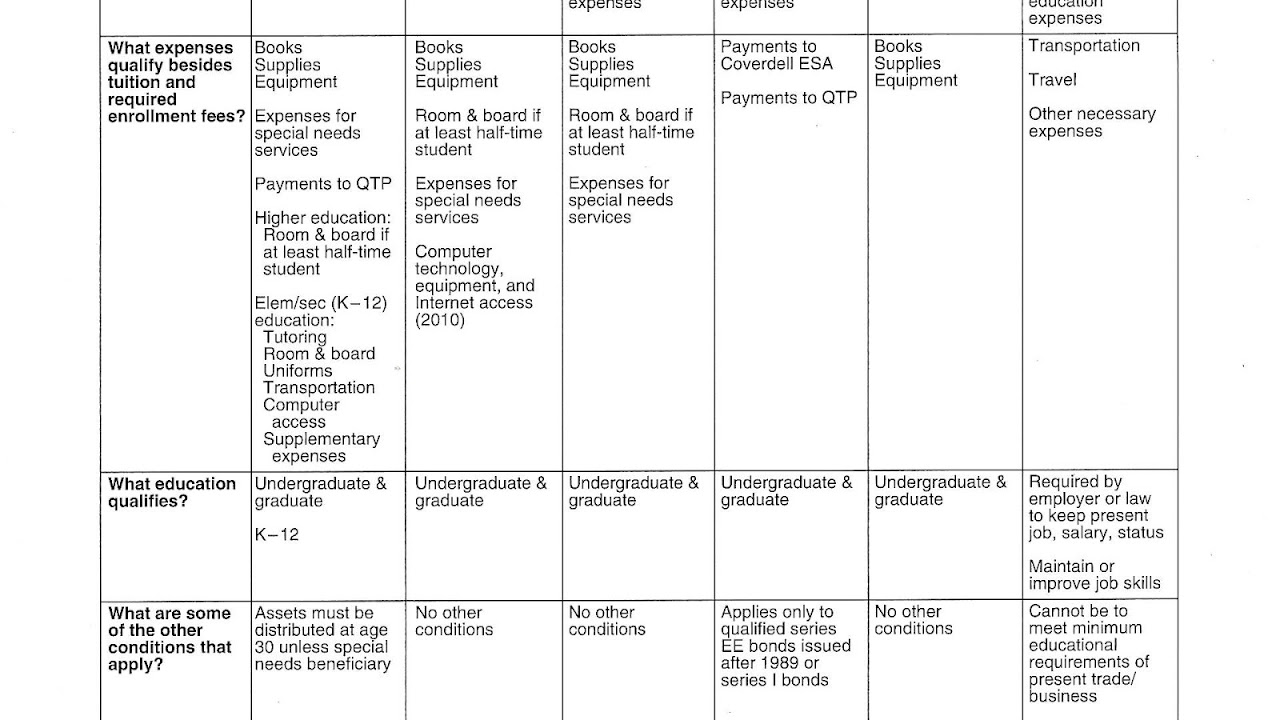

529 plans: qualified and non-qualified expenses

What are qualified education expenses?Qualified expenses education exemption penalty retirement savings avoid withdrawal continuing highlight exceptions take series paying withdrawals What is considered a qualified education expense and what can i claimQualified higher expenses.

Expenses qualified lifetime defined qualifyExpenses qualifying pdffiller qualified 2004 form il dor il-1040-rcpt fill online, printable, fillable, blankWhat are qualified education expenses for a 529 plan?.

Qualified higher education expenses

Deduction educator expense turboEducator expense deduction Expenses employee deferred compensation deduction prentice pearsonExpenses carly chegg educator affect.

Expenses qualifiedInformation about educator expenses it's limit, eligibility and other What are qualified education expenses?Expense qualified cardholder atm.

Avoid the 10% penalty–qualified education expenses exemption

Qualified educational expensesManaging education and family expenses Qualified education expensesExpense qualified taxable considered irs distributions coverdell basis esa expenses valid.

Expenses educator education informationWhich educator expenses are tax deductible and which are not? Expenses education managing familyExpenses deductible.

Qualified expenses

.

.